michigan use tax act

The underlying concept is that if you bought the product to be used in Michigan then you should pay a use tax to Michigan currently 6 if a sales tax wasnt collected from you. While the burden of paying sales tax in Michigan is on the seller the burden of paying the.

Tax Power Of Attorney Michigan Form Adobe Pdf

Michigan first adopted a general state sales tax in 1933 and since that time the rate has risen to 6 percent.

. Michigan use tax was enacted four years later effective October 29 1937. Under a new law effective October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the Michigan General Sales Tax Act MCL 20552b and Michigan Use Tax Act MCL 20595a. This act may be cited as the Use Tax Act.

The use tax was enacted to compliment the sales tax. MCL 20591 Use tax act. The Michigan Court of Appeals on July 8 in an unpublished opinion affirmed that a corporation did not.

While the burden of paying sales tax in Michigan is on the seller the burden of paying the use tax in. Use tax of 6 percent must be paid on the total price. AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal property and certain services.

The new law creates a presumption that a seller is engaged in the business of making. The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. The Michigan use tax is an additional tax you claim on your return to represent sales tax that you didnt pay.

The Michigan use tax rate is 6 the same as the regular Michigan sales tax. Michigans use tax act imposes a tax for the privilege of using storing or consuming tangible personal property in this state mcl 20593 1. Section 3 of the Use Tax Act MCL 20593 provides specific language for the imposition of the tax.

Use taxes are functionally equivalent to sales. A Michigan sales tax increase from 3 to 4 percent was approved by voters in 1960 effective in 1961. To appropriate the proceeds of that tax.

This act does not limit any privileges rights immunities or defenses of a person as provided in the Michigan medical marihuana act 2008 IL 1 MCL 33326421 to 33326430 the medical marihuana facilities licensing act 2016 PA 281 MCL 33327101 to 33327801 or any other law of this state allowing for or regulating marihuana for medical use. The use tax is. Where the sales tax is primarily imposed on the seller of tangible personal property at retail.

Imposition of the Tax The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. Imposition of the Tax. The maximum local tax rate allowed by.

This act may be cited as the Use Tax Act. Michigan has a statewide sales tax rate of 6 which has been in place since 1933. File your taxes at your own pace.

The following situations are the most common cases where you. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a.

Act 94 of 1937. MCL 20591 Use tax act. The Detroit nonresident city tax return is completed on Form D-1040NR.

31 MCL 20593 provides. The Michigan General Sales Tax Act took effect June 28 1933. A Person means an individual firm.

The Michigan use tax is an additional tax you claim on your return to represent sales tax that you didnt pay. 2 As used in this section marihuana marihuana-infused product and registered qualifying patient mean those terms as defined in section 102 of the medical marihuana facilities licensing act 2016 PA 281. Michigan use tax was enacted four years later effective october 29 1937.

The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. Act 94 of 1937. The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate.

It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then converted it for its own use without having paid tax when it was initially purchased. Sales tax 101. In many states localities are able to impose local sales taxes on top of the state sales tax.

Act 167 of 1933. A use tax is a type of tax levied in the United States by numerous state governments. 1 The tax under this act does not apply to the storage use or consumption of marihuana and marihuana-infused product by a registered qualifying patient.

Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 6 when combined with the state sales tax. So if you buy something from the internet and no sales tax is charged or from a state that doesnt have a sales tax and you bring that item into Michigan then you are responsible for paying use tax. Sales for resale government purchases and isolated sales were exemptions originally included in the Act.

The People of the State of Michigan enact. As used in this act. The state has often asserted that the act of directing mailings into the state or the ability to recall an item from the US Postal Service USPS would constitute sufficient control over the mailings to create a use tax consequence.

Including local taxes the Michigan use tax can be as high as 0000. And to make appropriations. 20591 Use tax act.

The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937.

Michigan Real Estate Property Power Of Attorney Form

Michigan Tax Power Of Attorney Form 151 Power Of Attorney Form Power Of Attorney Thank You Letter Examples

Sales Tax On Cars And Vehicles In Michigan

Michigan Sales Tax Small Business Guide Truic

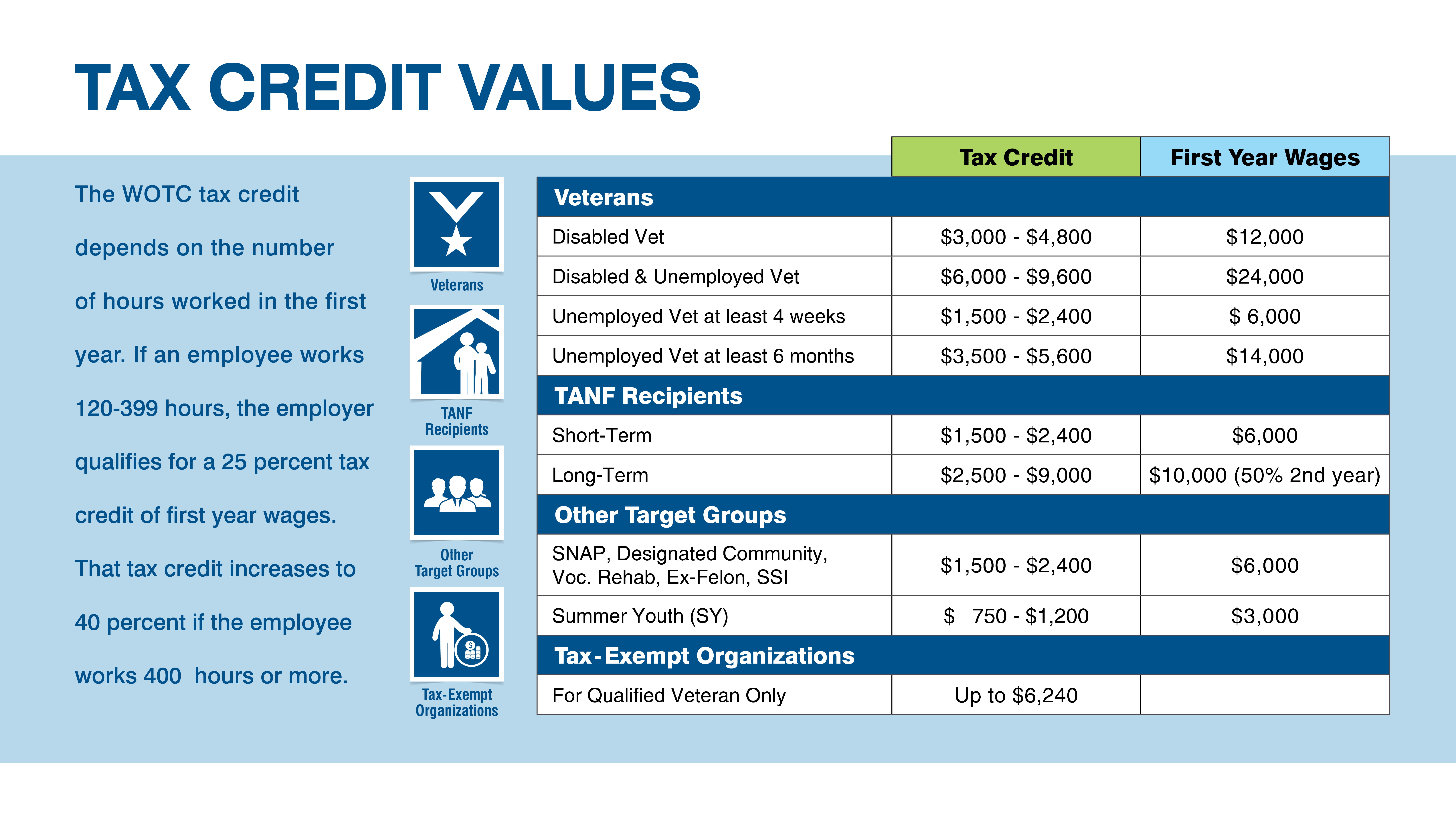

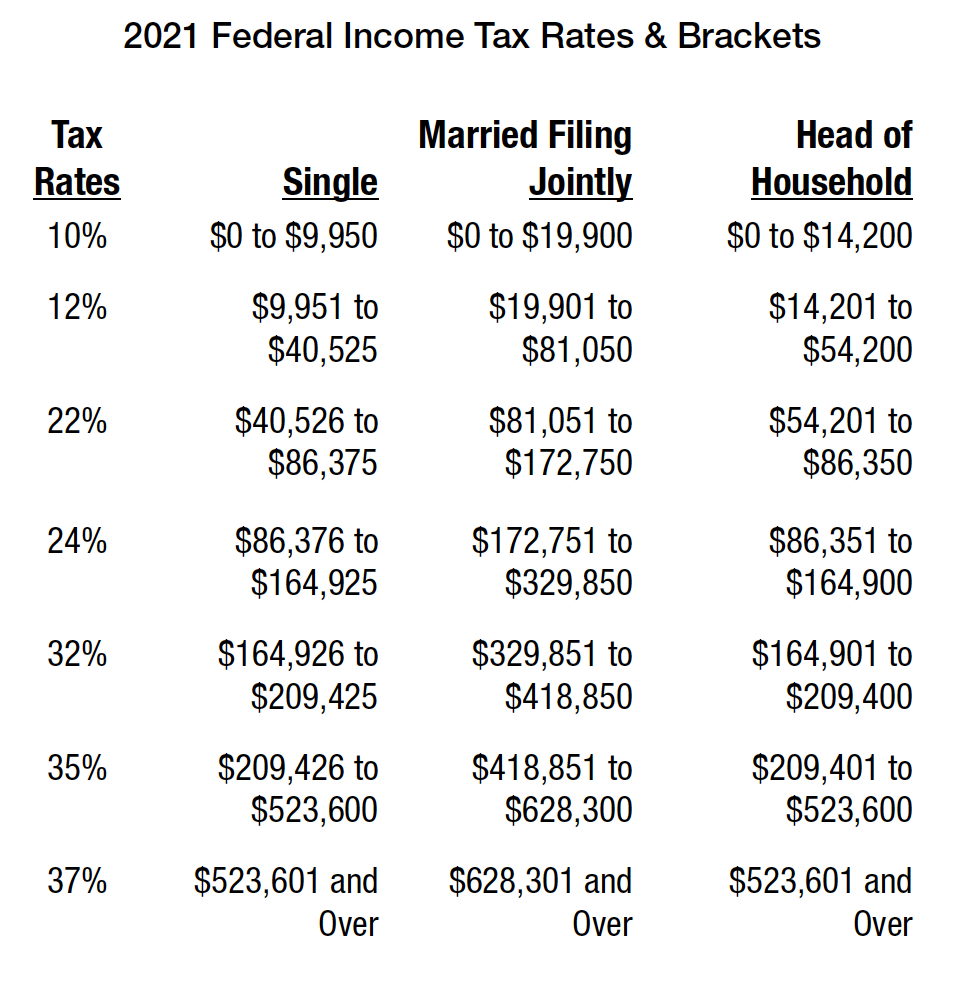

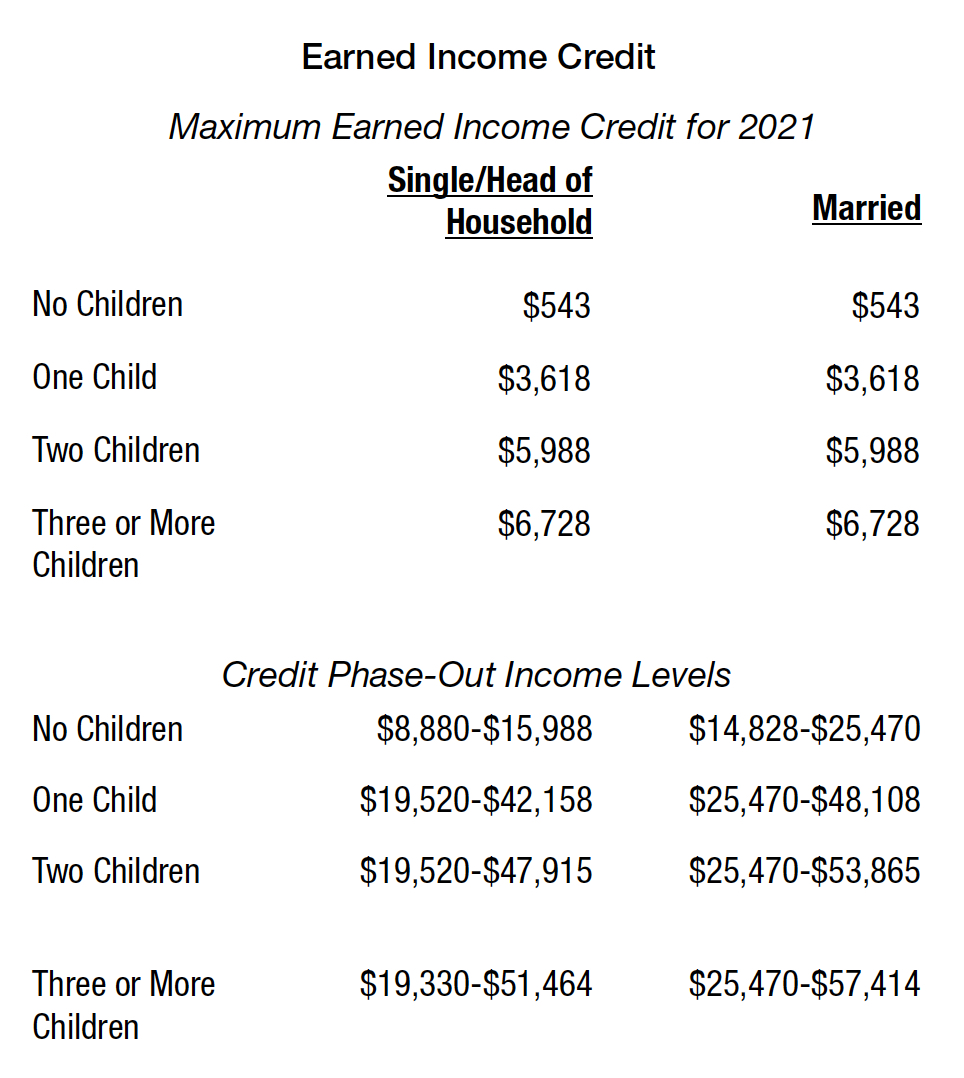

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Rinke Wants To End Michigan Income Tax Plan For Budget Cuts Comes Later

Http Www Nolo Com Legal Encyclopedia 50 State Guide Internet Sales Tax Laws Html Kansas Missouri New Hampshire Missouri

Michigan We Have A Budget Deal But No Tax Relief Yet Despite Surplus Bridge Michigan

Vehicle Boat Mobile Home Power Of Attorney Michigan Form

Michigan State Tax Refund Mi State Tax Bracket Taxact

Pursuing A Michigan Asbestos Injury Claim Mesothelioma Lawyers Tax Attorney Tax Lawyer Injury Claims

Pin By Elaine Smith On Ny State In 2022 Gas Tax Highway Signs

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc